How to get a loan for CLiQQ Wallet cash-in

1

Select a loan provider from our list below

We teamed up with credible and reliable loan partners to ensure that your loans are secured.

2

Complete a one-time identity verification

In compliance with BSP, the loan provider will conduct identity verification. You need to provide a valid government ID and your personal details.

3

Key in the CLiQQ Wallet code sent by the loan provider

The code will be sent via email or SMS. Loan amount will reflect real-time after you enter the code on your CLiQQ App. Learn more

4

Enjoy using your CLiQQ Wallet credits

Use your CLiQQ Wallet to buy merchandise at 7-Eleven stores, shop at CLiQQgrocery.com and more.

5

Pay loan easily

The loan provider will send instructions via SMS or email on how to pay your loan amount.

Don't have the CLiQQ App yet?

Download it now.

Simple requirements to avail the loan

Requirements may vary depending on your loan provider.

1 Valid Government Issued ID

Passport, Driver’s License, Company ID, TIN, SSS, Postal ID, Voter’s ID, PRC, NBI Clearance, National ID

Personal Details

Legal Name, Present & Permanent Address, Source of Income & Nature of Work

To get started, select a loan partner

You will be redirected to your selected loan partner's page to start verification.

How to claim CLiQQ Wallet credits from the loan provider

After loan approval, the loan provider will send a code so you can redeem wallet credits on your CLiQQ App.

Step 1

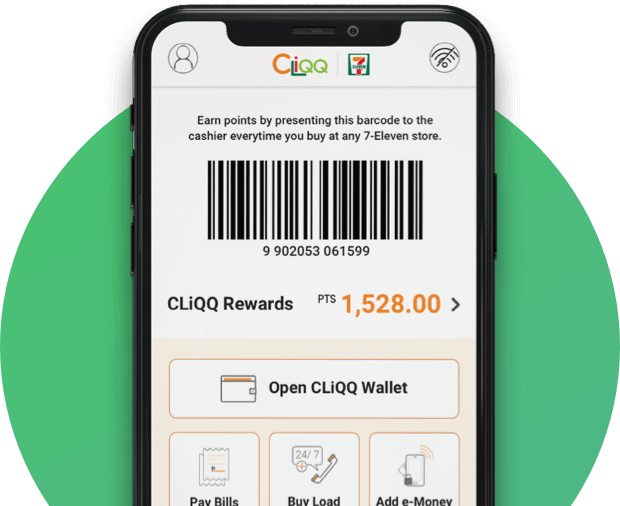

Tap "Open CLiQQ Wallet".

Step 2

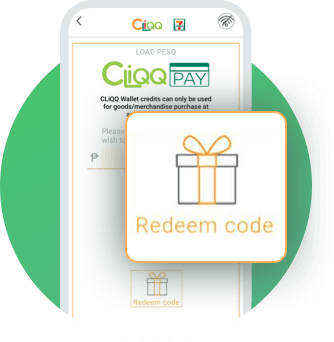

Tap "Load Wallet".

Step 3

Tap "Redeem Code".

Step 4

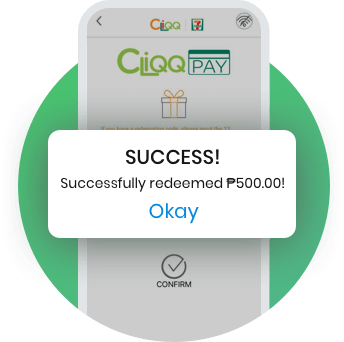

Input code sent by the loan provider then confirm.

Step 5

Success! The amount redeemed will reflect real-time on your CLiQQ App.

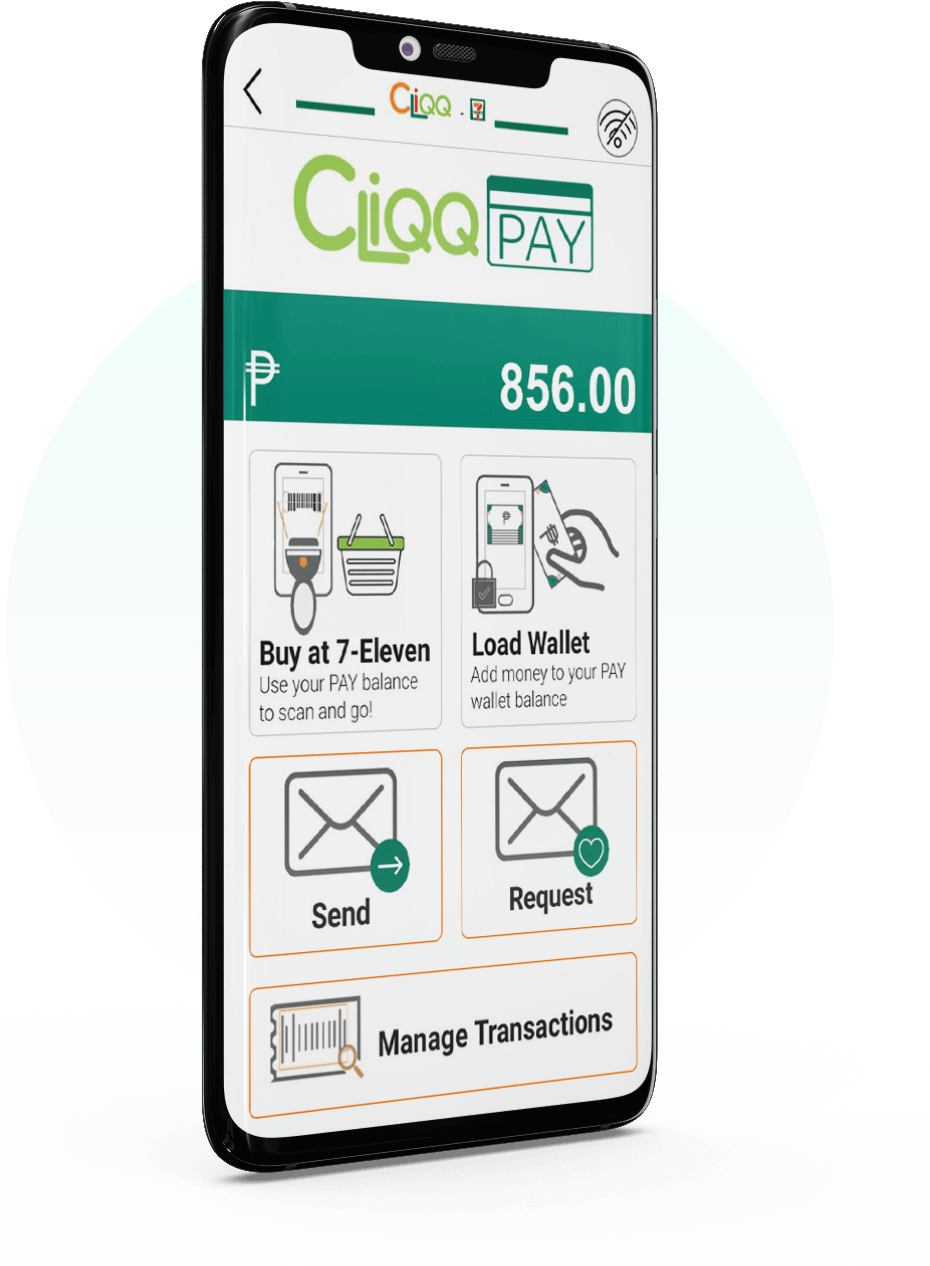

Enjoy these perks with your CLiQQ Wallet

Use CLiQQ Wallet credits as payment when you purchase physical merchandise at 7-Eleven stores or when you shop at CLiQQgrocery.com.

Earn 1 point for every PHP50.00 worth of purchase. The more you pay with your CLiQQ Wallet, the more points you earn.

Send or receive CLiQQ Wallet credits as payment to other CLiQQ users.

How to pay loans

Your loan provider will send you instructions via email or SMS with the steps you need to take in order to repay your loan.

Frequently Asked Questions

STEP 1: Select a loan provider from our list. We teamed up with credible and reliable loan partners to ensure that your loans are secured.

STEP 2: Complete the identity verification from the lender you chose.

STEP 3: After approval, the loan provider will send you the CLiQQ Wallet code that you need to input in the CLiQQ App in order to claim CLiQQ Wallet credits. The amount will reflect real-time.

STEP 2: Complete the identity verification from the lender you chose.

STEP 3: After approval, the loan provider will send you the CLiQQ Wallet code that you need to input in the CLiQQ App in order to claim CLiQQ Wallet credits. The amount will reflect real-time.

The minimum requirements include

1 Valid Govt. Issued ID

1 Valid Govt. Issued ID

- Passport

- Driver’s License

- Company ID

- TIN

- SSS

- Postal ID

- Voter’s ID

- PRC

- NBI Clearance

- National ID

- Legal Name

- Present & Permanent Address

- Source of Income

- Nature of Work

BSP requires one-time identity verification for many financial services, including loans. Customers who want to avail such services need to provide their personal details, including their name, address, ID and source of income. For CLiQQ Wallet loans, this information will be approved by the loan provider. It is also known as KYC or “Know your customer”.

- Use CLiQQ Wallet credits as payment when you purchase physical merchandise at 7-Eleven stores or when you shop at CLiQQgrocery.com.

- Earn 1 point for every PHP25.00 worth of purchase. The more you pay with your CLiQQ Wallet, the more points you earn.

- You can send CLiQQ Wallet credits as payment to other CLiQQ users.

1. Tap “Open CLiQQ Wallet”

2. Tap “Load Wallet”

3. Tap “Redeem Code”

4. Input redemption code then confirm

2. Tap “Load Wallet”

3. Tap “Redeem Code”

4. Input redemption code then confirm

Your selected loan provider will be the one to send you instructions on how to repay your loan, either via email or SMS.

×

↔

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.